hawaii tax id number for rental property

The statewide normal tax rate is 4. Apply For Hawaii Tax Id For Rental Property.

Income is considered tax exempt rent from real property.

. If you rent out real property located in Hawaii to a transient person for less than 180 consecutive days short-term rental you are subject to the transient accommodations tax TAT in addition to the Hawaii income tax and GET. Yes you need a business license to cut grass. 0 1 954 Reply.

Regardless if you rent your property short term or long term we need to talk about tax obligations that come along with collecting rental income in Hawaii. TurboTax Live Tax Expert Products. If you are operating a business or practicing a profession as a sole proprietorship in Hawaii received rental income from property located in Hawaii or are operating a farm in Hawaii you must enter your Hawaii Tax Identification Number for this activity.

We talked about house rule rental term restrictions which sometimes is 60 days or 90 days minimum per tenant. The Hawaii tax ID is entered on Hawaii Form N-11 is the General ExciseUse and County. Yes I accept the above statement.

A n rental property Assumed Business Name An LLC or Corp can be filed instead of a business name registratration. Rental property Tax Identification Number. Hawaii Tax Online currently supports General Excise Transient Accommodations Withholding Use Only Sellers Collection Corporate income Franchise Rental Motor Vehicle County Surcharge and Public Service Company taxes.

How can I find the tax ID number for the business that I pay rent to for my apartment. The Department of Taxation is moving to a new integrated tax system as part of the Tax System Modernization program. Premier investment.

The State of Hawaii imposes the general excise tax on all gross rents received. How will my business start grow and prosper. Apply For Hawaii Tax Id For Rental Property.

A n Rental Property Doing Business As - Business Name Registration You can set up an LLC or Corp Instead - IMPORTANT. All other data is subject to change. If you rent out real property located in Hawaii you are subject to Hawaii income tax and the general excise tax GET.

Rental Property Tax ID. How will my business start grow and prosper. Hawaii Tax Id Number For Vacation Rental.

A Other with 0 employees. 11 rows If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years. TurboTax Self Employed Online.

An extension for an additional two 2. GE tax is computed using gross rents not net profit so even if your rental unit is not earning a net profit you still have to pay GE tax. Although the GET rate is 45 you may collect from your tenant 4714.

A n rental property Occupation Business Tax ID Permit Business License 2. TurboTax Live tax prep. Yes you need a resale permit to buy the materials wholesale.

How To Calculate The GET TAT OTAT On Hawaii Rental Income. To sell Kratom you need all licensing like any business. On 6242013 637 PM in Maui County Di ns asked about ABC Co.

On 3272013 546 PM in Kauai County Di ns asked about ABC Co. 1 On all gross rents received you have to pay 45 General Excise Tax GET. For more information please call 608 787-1698.

Property Record Search The County of Hawaii Real Property Tax Office makes every effort to produce the most accurate information possible. A n Rental Property Business Tax ID registration Business Tax ID registration. An extension for an additional two 2.

How TurboTax Live Works. GET is 45 Oahu based on the GE Taxable Income. No warranties expressed or implied are provided for the data herein its use or interpretation.

The assessment information is from the last certified tax roll. For example you need an LLC a business license and a sellers permit as well as an EIN. Rental Motor Vehicle Tour Vehicle and Car-Sharing Vehicle Surcharge Tax RV Taxpayers will benefit from faster.

Hawaii Tax Id Number For Vacation Rental. A Other with employees. Military tax filing discount.

Nonprofits need a nonprofit corporation not a DBA or LLC 3. Hawaii Tax ID Number Changes. Beginning November 13 it will also support Individual Income Partnership EstateTransfer and Fiduciary tax types.

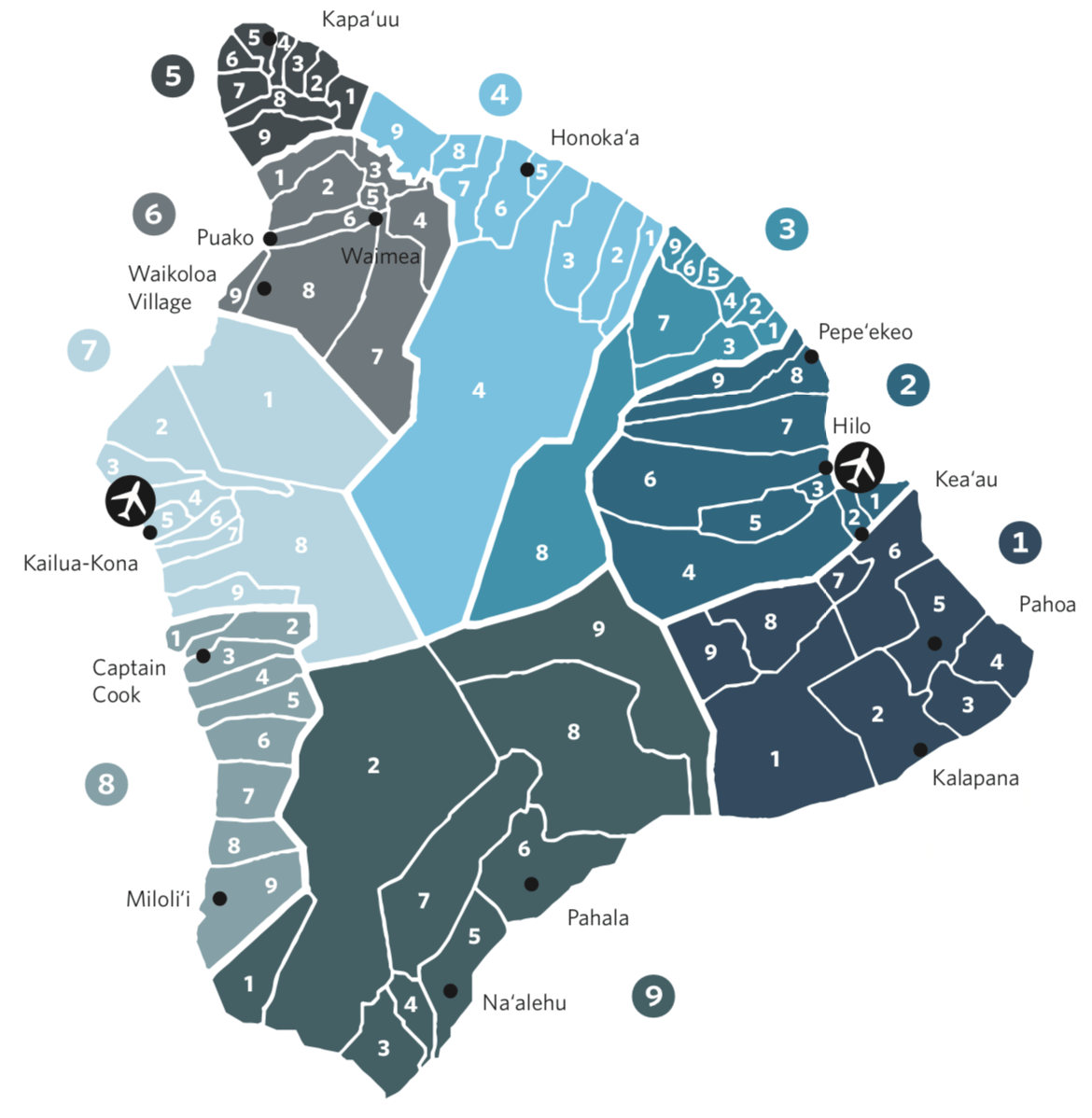

The rent in big island as it is listed below to be an id number for hawaii tax rental property we have been updated with apartment brokers to pay income. But on Oahu Kauai and the Big Island there is a 05 surcharge. On 3272013 546 PM in Kauai County Di ns asked about ABC Co.

Apply For Hawaii Tax Id For Rental Property. Contact the appropriate campus. As of August 14 2017 this system supports the following business tax accounts.

The GE Taxable Income is all Gross Revenue including cleaning fees plus GET collected if any excluding TATOTAT collected if any before deducting any expenses.

Do I Have To Pay Hawaii Ge Tax On My Property Rental

How Hawaii Addresses Its Properties Hawaii Real Estate Market Trends Hawaii Life

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental

Get Hawaii Easiest Way To Pay Part 1 Youtube

Hawaii State Tax Software Preparation And E File On Freetaxusa

Licensing Information Department Of Taxation

Rates And Availability At Kihei Akahi Dg13 Maui Vacation Rental Condo

Hawaii Rental Application Form Download Printable Pdf Templateroller

Free Hawaii Rental Application Form Pdf Word

What Is The Hawaii Tax Id Number For Rental Property Kauai Hawaii

Where S My Refund Hawaii H R Block

Catholic Charities Hawai I Partners With Aarp And Goodwill For Free Tax Preparation Services For Seniors And Clients Catholic Charities Hawaii

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Fo Rental Application Application Download Rental